Have you ever wondered how finance can operate without traditional banks or financial institutions? The answer might lie in an exciting and innovative space known as decentralized finance, or DeFi for short. This rapidly growing sector is reshaping the way individuals think about money, transactions, and financial services.

Understanding Decentralized Finance (DeFi)

Decentralized Finance refers to a blockchain-based form of finance that does not rely on central financial intermediaries such as banks or brokers. Instead, it allows individuals to transact directly with one another through smart contracts on blockchain networks, primarily Ethereum. By utilizing blockchain technology, DeFi empowers users to keep control over their own assets and eliminates many of the barriers typically associated with traditional finance.

In simple terms, DeFi is about democratizing finance. It provides an open-source framework that anyone can access, contributing to a more transparent and inclusive financial ecosystem.

Key Characteristics of DeFi

To give you a better understanding, let’s highlight some of the essential characteristics that define Decentralized Finance:

-

Transparency: All transactions made on a blockchain are publicly available and immutable. This transparency fosters trust among users as they can independently verify the validity of transactions.

-

Accessibility: DeFi platforms are open to anyone with an internet connection. This inclusiveness ensures that individuals from various socio-economic backgrounds can participate in financial activities without the need to meet stringent requirements set by traditional banks.

-

Interoperability: Many DeFi applications are designed to work seamlessly with one another, allowing users to move assets across platforms easily. This feature enhances the overall user experience and creates a more connected financial ecosystem.

-

Programmability: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automate financial processes, reduce costs, and minimize the chances of disputes.

How DeFi Works

Understanding how DeFi operates can be a bit overwhelming at first, but breaking it down into segments can make it easier to grasp.

1. Smart Contracts

At the core of DeFi is the concept of smart contracts. These are complex algorithms coded on blockchain that facilitate and enforce the terms of an agreement without the need for intermediaries. When certain conditions are met, actions defined in the contract are executed automatically—such as a loan approval or interest payment.

An analogy can be helpful here. Consider a vending machine: once you input your money and select your snack, the machine automatically dispenses your choice. Similarly, smart contracts automate agreements without human intervention, reducing the chances of error or fraud.

2. Cryptocurrency

DeFi platforms primarily operate on cryptocurrencies. These digital assets serve as the medium of exchange and provide the necessary liquidity for transactions. For example, Ethereum (ETH) is commonly used for transaction fees on many DeFi platforms, enabling users to interact with various financial services built on its blockchain.

3. Decentralized Applications (DApps)

DeFi platforms are often powered by DApps—decentralized applications that run on the blockchain. These applications can offer various financial services ranging from lending, borrowing, trading, and insurance, among others. Each DApp functions independently, allowing users to choose which services they want to engage with and maintain complete control over their finances.

This image is property of www.investopedia.com.

Common Applications of DeFi

Now that you have an understanding of the building blocks of DeFi, let’s look at some of the most popular applications you might encounter in this ecosystem:

1. Decentralized Exchanges (DEXs)

A decentralized exchange allows users to trade cryptocurrencies directly with one another without the need for a centralized authority. This model not only increases privacy and control but also reduces the risk of hacks often associated with centralized exchanges. Users can maintain control of their funds and trade directly from their wallets.

| DEX Features | Traditional Exchange |

|---|---|

| User Control | Limited control |

| Privacy | Less privacy |

| Security | High risk of hacks |

| Fees | Lower fees |

2. Lending Platforms

Lending platforms enable individuals to lend their cryptocurrencies in exchange for interest payments, or borrow against their crypto holdings. These platforms often use smart contracts to facilitate lending and borrowing quickly and securely. Borrowers can access funds without undergoing credit checks, while lenders can earn passive income on their assets.

3. Yield Farming and Liquidity Mining

You might have heard about yield farming and liquidity mining, which essentially involve providing liquidity to the DeFi ecosystem in exchange for rewards. During yield farming, you provide your assets to a protocol, which then lends them to other users, and you earn interest or governance tokens. Liquidity mining, on the other hand, rewards liquidity providers with tokens that can grant special privileges like voting on project developments.

4. Insurance

DeFi insurance platforms offer coverage against various risks associated with using DeFi services, including smart contract bugs or hacking incidents. These platforms use decentralized models to pool funds from users, allowing for more affordable and accessible insurance options compared to traditional insurance providers.

The Risks of DeFi

While there are plenty of benefits to exploring DeFi, it’s essential to be aware of the risks involved. Here are a few key concerns you should consider:

1. Smart Contract Vulnerabilities

Although smart contracts automate transactions, they can contain bugs or vulnerabilities that hackers can exploit. Malicious actors may identify weaknesses in the code, leading to financial losses for the users involved. Remember the saying, “code is law”—there’s no human oversight once a smart contract goes live!

2. Market Volatility

Cryptocurrencies are often subject to high volatility. As a result, the value of your assets can fluctuate significantly, which presents a risk when engaging with DeFi platforms. Safety in numbers is important, so consider diversifying your investments to spread risk.

3. Regulatory Uncertainty

The regulatory landscape surrounding DeFi is still evolving. Governments worldwide are exploring more stringent regulations aimed at protecting consumers and stabilizing financial markets. If laws change, it could impact your ability to use certain DeFi services or incur tax obligations.

4. Lack of Customer Support

Decentralized platforms often lack extensive customer support compared to traditional financial institutions. When you face issues while using a DeFi service, you are more likely to need to rely on community resources like forums or social media rather than a dedicated customer support team.

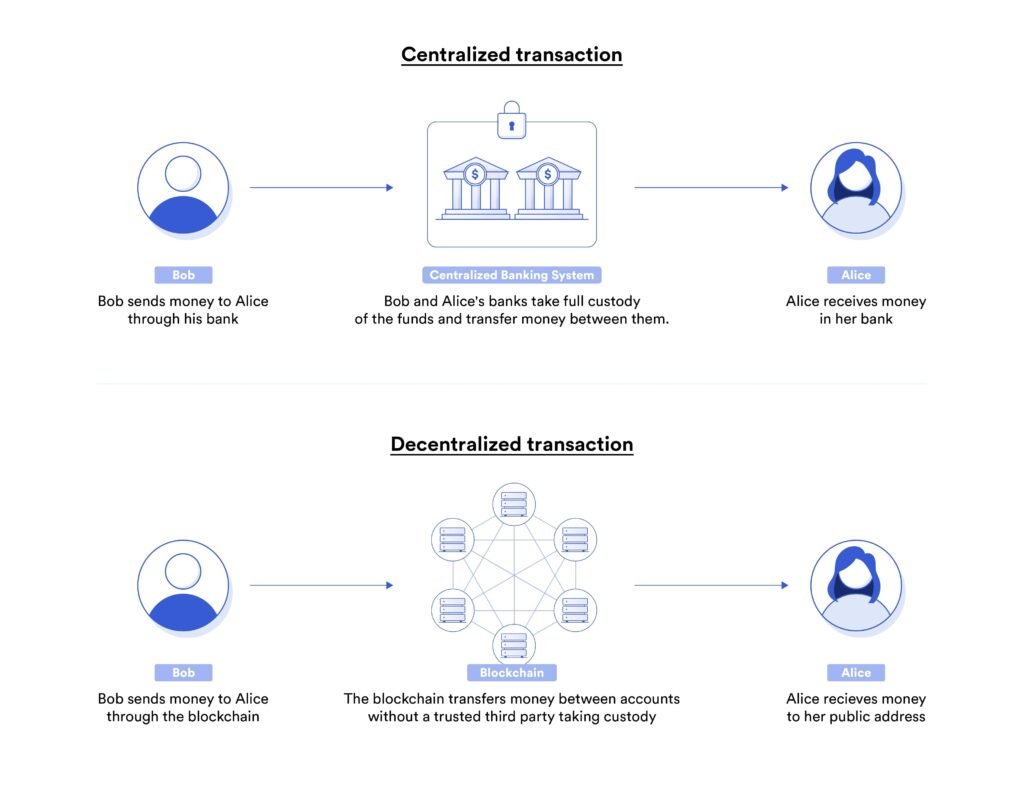

This image is property of cdn.prod.website-files.com.

DeFi vs. Traditional Finance

When comparing DeFi to Traditional Finance (TradFi), it’s crucial to understand the fundamental differences. Here’s how they stack up against each other:

| Aspect | Decentralized Finance (DeFi) | Traditional Finance (TradFi) |

|---|---|---|

| Control | Users have full control over funds and assets | Control rests with financial institutions |

| Accessibility | Open to anyone with internet access | May require identification and lengthy processes |

| Fees | Generally lower fees | Often includes high fees and commissions |

| Transaction Speed | Allows near-instant transactions | Can involve delays due to intermediaries |

Understanding these differences can help you determine which system aligns better with your financial goals and values.

Getting Started with DeFi

If you’re considering entering the DeFi space, here’s a step-by-step guide to help you get started.

1. Education and Research

The first step is to educate yourself about DeFi and its various components. Familiarize yourself with terms like liquidity, yield farming, and smart contracts. Read articles, watch videos, and engage with community forums. Knowledge is power—being informed helps you make confident decisions!

2. Choose a Wallet

To interact with DeFi platforms, you’ll need a cryptocurrency wallet. Popular choices include MetaMask, Trust Wallet, and Coinbase Wallet. These wallets can store your cryptocurrencies and allow you to connect with various DApps.

3. Acquire Cryptocurrency

Next, you’ll need to acquire some cryptocurrency to use within DeFi. You can purchase cryptocurrency from exchanges like Coinbase, Binance, or Kraken. Make sure you have some Ethereum (ETH) on hand, as it’s commonly required for transaction fees on many DeFi applications.

4. Select DeFi Platforms

Once you have your wallet set up and cryptocurrency on hand, it’s time to explore different DeFi platforms. Research and evaluate various applications based on your interests, such as lending, borrowing, or trading—all while ensuring you feel comfortable with the risks involved.

5. Start Small

While it’s tempting to dive in with substantial investments, consider starting small to reduce risk. Experiment with different DeFi services and gradually grow your exposure as you gain experience and confidence in the space.

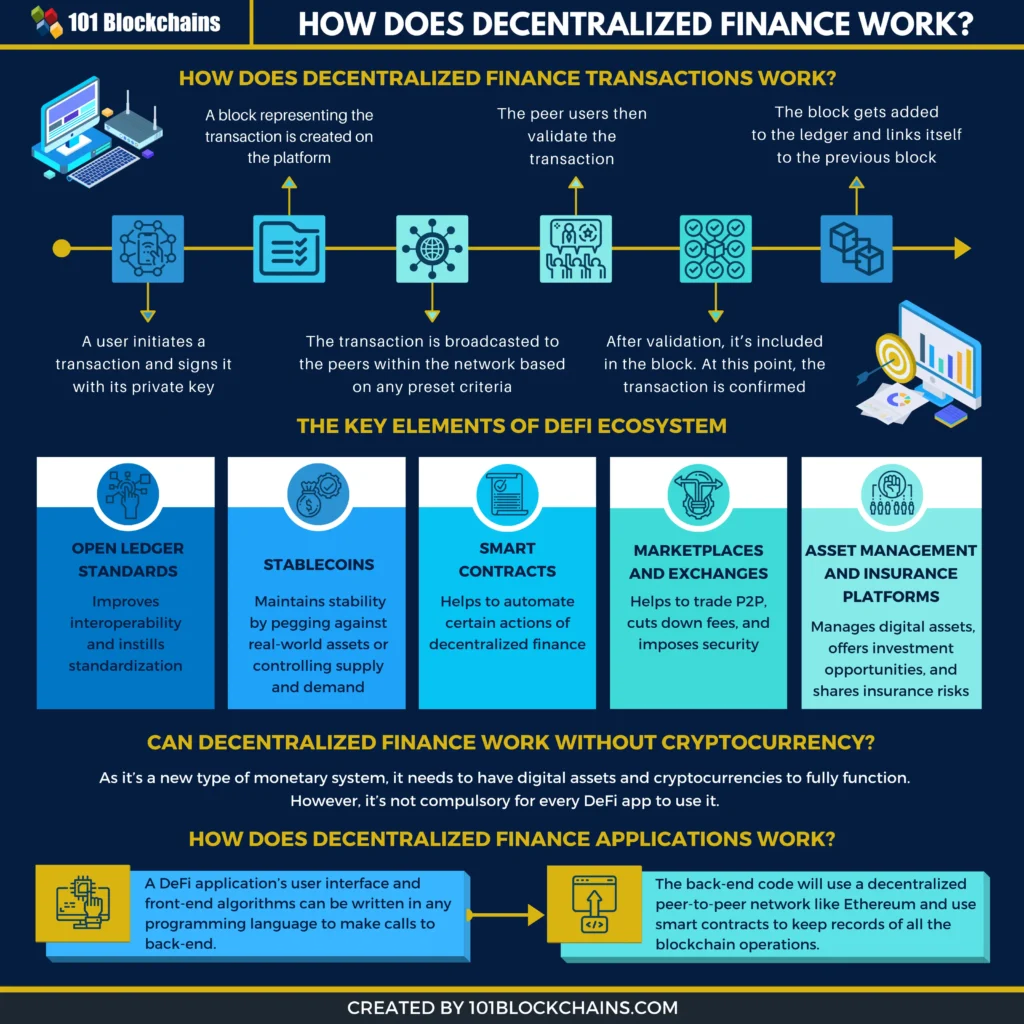

This image is property of appinventiv.com.

The Future of DeFi

Looking ahead, the potential for DeFi is enormous. As the technology matures, more users are discovering the benefits of decentralized finance. With projects continuously evolving, expect to see innovations that simplify processes and enhance the user-friendly experience.

Regulatory frameworks are also expected to develop, likely supporting the legitimacy and security of DeFi platforms. As various financial institutions begin to recognize the importance of blockchain and decentralized systems, we can imagine a future where DeFi and traditional finance work hand-in-hand.

Conclusion

Decentralized Finance has ushered in a new way of thinking about money and finance, providing opportunities for individuals to take control of their financial future. While the risks are evident, the benefits of transparency, accessibility, and innovation make DeFi an intriguing space worth considering.

By equipping yourself with knowledge and starting slowly, you can become part of this financial revolution. The world of DeFi is yours for the taking—will you step in?

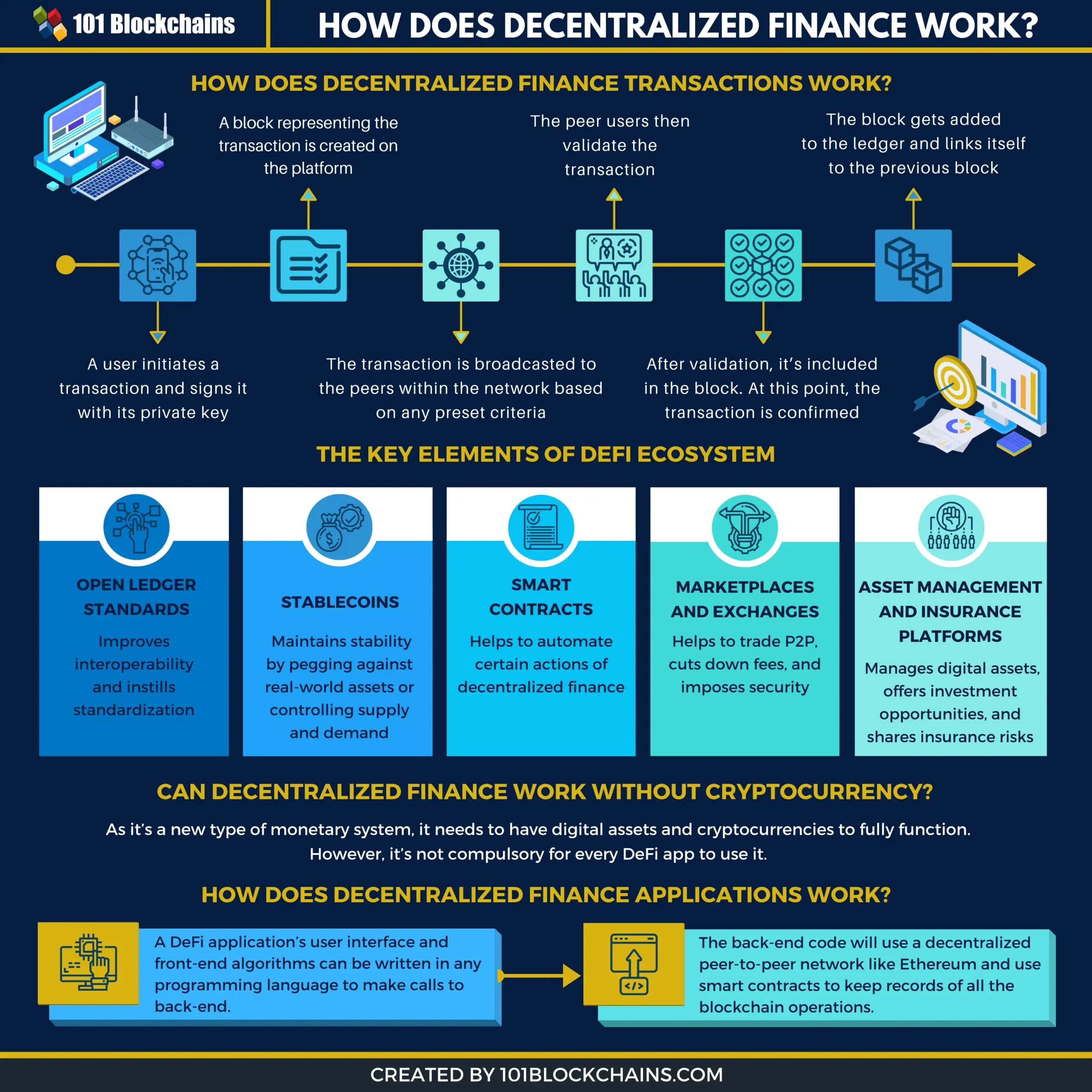

This image is property of 101blockchains.com.